This is how you set it up in practice

Are you convinced that remanufacturing makes sense for your product? If so, you may have already made an initial assessment of your remanufacturing business case, based on our practical tips. Now it's time to draw up a cost model. In practice, remanufacturing often involves some unknown or invisible costs, which you should investigate as soon as possible. This article gives you a handy step-by-step plan.

In previous blogs, we discussed the three most important factors involved in drawing up your business case: the sale prices, the purchase prices of the cores (the discarded products that you want to remanufacture) and the operational costs required to renew them. Amongst the things to consider are inspection, cleaning and disassembly.

The known costs

The total remanufacturing cost is the sum of many underlying activities and their costs. Understanding these costs will help you determine the economic feasibility of your remanufacturing concept.

|

Start with the costs that you already know or that you can influence yourself. Separate the costs for logistics and for buying the cores from the operational costs required to make the product ready for sale again.

What about the costs associated with labour, parts, cleaning, inspection, etc? You can estimate those as you know more-or-less what range they fall in. In the first iteration, a cost estimate based on 'gut feeling' (the experience and expertise of employees) is sufficient.

In the next phase, you will estimate these costs more specifically. List the activities and costs that are comparable to your current assembly and production. It is best to make a separate estimate for the materials costs of the parts that you will reuse in remanufacturing. These may vary depending on the condition and quality of the incoming product.

The 'new' costs

The real ‘new’ costs come from cleaning, inspection and waste disposal – especially if you need to dispose of hazardous or polluting materials. Think, for instance, of oil, cooling gases, toners or materials with toxic additives.

Cleaning processes

Cleaning is usually the most important additional cost. Consider when cleaning takes place: before or after disassembly? Or only after the entire remanufacturing process? Or a combination of those options? If you already have experience with cleaning processes (degreasing, blasting, de-coating, etc.), you can estimate those costs better. You can also request information from suppliers of cleaning equipment or fellow entrepreneurs.

Waste after cleaning and dismantling

What kinds of waste are created during the cleaning and dismantling of incoming parts? Estimate their volumes in tonnes per year or kilograms per product. In this phase, a rough estimate of the costs is sufficient: the volume multiplied by the costs for removal and processing. Your environmental coordinator can give a price indication for waste collection and processing.

Inspection

It is important to perform inspection and validation early in the remanufacturing process. In most start-up phases this can be done manually – flexible, but also more time-consuming. So be sure to check whether you need certain (expensive) specialised testing and inspection equipment.

Other costs

We use a different approach to calculate the other costs. In the example below, we assume that the operational costs are reasonably well known, but the costs for purchasing the cores are not.

To determine what you can spend on buying cores, perform a simple calculation.

|

If this value is very low, or even negative, you should amend your remanufacturing concept. Is the value positive? Then consider the margin you want to use. A large margin entails a small risk but provides less flexibility when purchasing cores – and vice versa. In the next step, you can (try to) purchase cores within the price range you have determined.

You can also follow the above logic if you have a good idea of the costs for core purchasing but not of the operational costs. First, collect the known costs and calculate whether there is sufficient room for your margin and the missing costs.

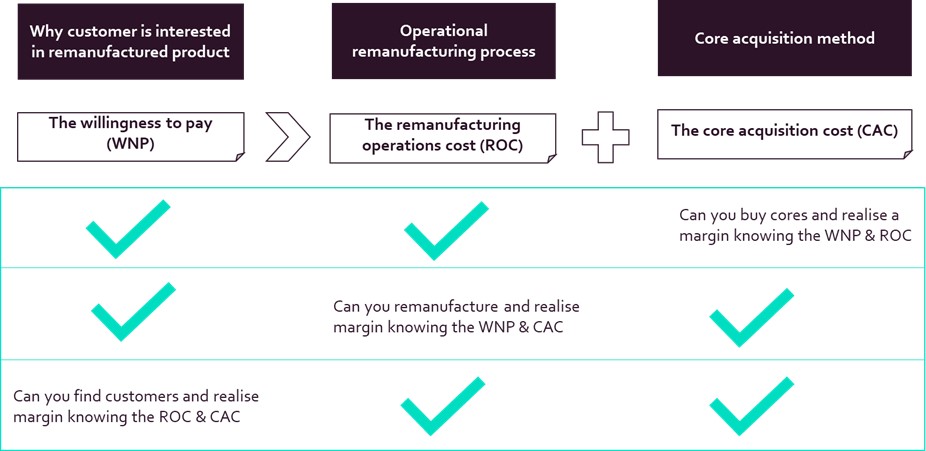

The diagram below shows all possible combinations. In summary, the willingness to pay must be significantly greater than the sum of the core purchasing costs and the operational costs.

|