The Nordics offer strategic opportunities Belgian companies cannot overlook

On December 10th, Sirris and Agoria Energy Technology Club will be hosting a Nocturne that focuses on market opportunities in the Nordics. Rich in critical raw materials, the region has established itself as a cornerstone for renewable energy technologies, sustainable industrial practices, and resilient supply chains. Given the EU’s emphasis on reducing dependency on external imports, partnering with the Nordics presents Belgian companies with a pathway to secure, ethical, and sustainable resources essential for the energy transition.

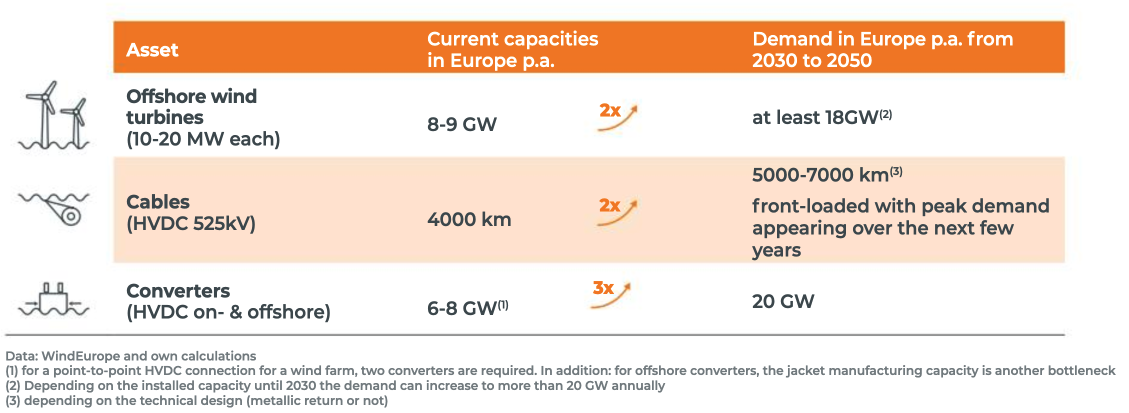

1 | The annual demand for offshore assets in Europe is going to double

According to Elia, Europe’s annual demand for offshore wind assets is set to double by 2030-2050, requiring significant increases in production capacity for turbines, cables, and converters to meet domestic needs. This could create 300,000 jobs across the supply chain. To sustain leadership in offshore wind, Europe needs a substantial investment framework to drive innovation, with potential hubs for manufacturing and innovation. In line with the EU Wind Energy Targets, the Nordic countries have established their own wind energy targets:

- Denmark: Aims to install 13 GW of offshore wind capacity by 2030.

- Sweden: Plans to reach 20-30 GW of offshore wind capacity by 2030.

- Norway: Targets 30 GW of offshore wind capacity by 2040.

- Finland: While specific offshore wind targets are less defined, Finland is actively expanding its wind energy capacity, with significant projects underway.

2 | The demand for onshore assets will tripple by 2050

The EU will need 750 GW of onshore wind in 2050 to deliver climate neutrality up from 173 GW today, according to WindEurope. The EU’s electricity system will more than double by 2050. It will grow to 6,800 TWh up from 3,000 TWh today. Major investments are to be expected.

3 | The Nordics have ambitious offshore wind goals

The Nordics aim for 120 GW of offshore wind by 2030 and 300 GW by 2050, which aligns with the 2023 Ostend Declaration. This massive transition toward renewable energy presents opportunities for Belgian companies with expertise in offshore wind and grid integration. The projected financial needs for offshore grid infrastructure in Europe are monumental: an estimated 264-304 billion euros by 2050. The push towards automated system management and hybrid offshore energy systems necessitates innovative maintenance, digital twins, and real-time data integration. Belgian firms with advanced digital tools or automation technologies could contribute here.

4 | Transferring all that power across Europe will require an HVDC grid expansion

Meshed HVDC grids are the preferred solution for integrating offshore renewables due to increasing distances from shore and the need for system interoperability. These are expected between 2025-2045. We also expect 22 new 6 GW transmissions by 2040 between Belgium and Denmark, aiming for EU-wide interconnection by 2045. However, there are also needs on a more operational level: emerging market designs, particularly nodal pricing mechanisms, focusing on maximizing social welfare and system efficiency. Belgian firms can bring insights into regulatory frameworks or contribute to market model development in the Nordics.

5 | The Nordics are abundant in critical raw materials

The Nordics are rich in essential minerals and metals, which are crucial for technologies in solar panels, batteries, and wind turbines. Accessing these materials in Europe can help reduce supply chain vulnerabilities, especially given the uncertain geopolitical dynamics in China and the US.

Raw material | Used for? | Can be found where? |

|---|---|---|

| Iron Ore | Steel production | Sweden (Kiruna and Malmberget mines) |

| Nickel | Stainless steel, batteries, alloys | Finland (Talvivaara), Norway |

| Copper | Electrical wiring, electronics, renewable energy | Norway, Finland |

| Zinc | Galvanizing steel, batteries, anti-corrosion alloys | Finland (Pyhäsalmi mine) |

| Gold | Jewellery, electronics, financial assets | Sweden, Norway, Finland |

| Cobalt | Batteries (EVs, electronics) | Finland (Kainuu region) |

| Rare Earth Elements (REEs) | Electronics, magnets, green energy, military | Greenland, Sweden (Norra Kärr), Norway |

| Phosphate | Fertilizer production | Norway, Finland |

| Titanium (Ilmenite) | Pigments, aerospace, high-strength alloys | Norway |

| Vanadium | Energy storage, steel alloying | Norway, Sweden |

| Graphite | Battery anodes, lubricants, refractory materials | Norway, Sweden |

| Silicon | Solar panels, electronics, aluminium alloying | Norway |

| Lithium | Battery technology (EVs, energy storage) | Norway (continental shelf), Finland |

| Olivine | Steel production, carbon capture | Norway (Sunnfjord region) |

| Uranium | Nuclear energy production | Sweden, Finland |

| Platinum Group Metals (PGMs) | Catalytic converters, fuel cells, electronics | Finland (Suhanko project) |

| Molybdenum | Steel alloying, renewable energy technology | Norway, Sweden |

| Chromium | Stainless steel production, industrial alloys | Finland (Kemi mine) |

| Lead and Silver | Electronics, jewellery, batteries, radiation shielding | Sweden, Norway |

| Other Industrial Minerals | Construction, ceramics, glass production | Various Nordic regions |

6 | The battery ecosystem in the Nordic Battery Belt

The Nordic Battery Belt is an emerging network of cooperation across Norway, Sweden, and Finland aimed at supporting the growth of the battery industry in the region. This cluster leverages local raw materials and clean energy to meet increasing global demand for batteries, focusing on sustainable logistics and reduced carbon footprints. Key companies driving innovation include FREYR in Norway and projects by Grafintec and Sibanye-Stillwater Keliber in Finland, which are constructing battery components and production facilities.

7 | A true innovator in green steel production

The Nordics are pioneering green steel using hydrogen instead of coal, significantly reducing carbon emissions. As steel is vital to various industries, this development aligns with EU decarbonization goals, making Nordic partnerships valuable for sustainable industrial operations.

8 | Potential in deep-sea mining for critical minerals

Norway is exploring deep-sea mining, particularly for critical minerals like cobalt, copper, and nickel. Since 2012, Belgian player Global Sea Mineral Resources (DEME) has been exploring the possibility of collecting seafloor polymetallic nodules. Do you want to know why GSR calls them polymetallic? Have a look here.

9 | Proximity = increased supply chain security

Belgian companies can reduce dependency on global markets by integrating Nordic resources into their supply chains, particularly in light of recent disruptions. The Nordics’ proximity and (geo)political stability provide Belgian companies with more predictable and resilient supply chains for critical materials.

10 | Belgian innovations can make a difference in the Nordics

The most considerable mining costs are labour and fuel, making it hard for the Nordics to compete with countries such as China, the Democratic Republic of the Congo (DRC), India, Russia, and Brazil. Belgian mining company Behault, in collaboration with Autonomous Knight, operates cyber-physical electric hybrid (semi-) autonomous vehicles for open pit surface mining. In short, these autonomous vehicles allow Nordic mining companies to compete with low-cost mining regions as they do not need to take on high labour or fuel costs.

11 | Significant opportunities for data centres and hyperscale computing

The Nordic Data Center Colocation Market was valued at 800 million euros in 2023 and is expected to reach 1,53 billion euros by 2029, rising at a CAGR of 11.42%. The region is rich in hydroelectric power and boasts a clean, low-cost renewable energy infrastructure, ideal for energy-intensive industries such as data centers. This has attracted major data centres, including those from Google and Meta. For Belgian companies, partnering with Nordic data centres offers the chance to deploy energy-efficient, low-carbon digital infrastructure to support their operations, contributing to sustainability goals. Unlike other areas, the colder temperatures here allow for natural free cooling. However, global supply chain issues are causing frequent delays in obtaining necessary power and temperature installations, leading to difficulties meeting project deadlines. Nevertheless, Norway, Denmark, and Sweden are leading the way in driving developments across the Nordic region.

12 | Alignment with EU sustainability goals

Nordic mining and production practices adhere to strict environmental and ethical standards, which align well with EU goals for responsible sourcing and sustainable development.

13 | High engagement in EU R&D

Nordic countries are deeply involved in EU research and development networks, providing Belgian firms with an opportunity to co-develop advanced technologies. This collaboration strengthens Belgium’s standing in the European value chain.

14 | Attraction of investment in R&D and clean technology

With strong government and private investment in renewable technology and R&D, the Nordics are a hotbed for innovation. By working with Nordic firms, companies in the sustainable energy sector can leverage this innovation ecosystem for cutting-edge, sustainable solutions.

Discover the opportunities for your business in the company of experts,

policymakers and other innovative entrepreneurs

Antwerp - December 10, 16:00-22:00

Nocturne | Market opportunities in the Nordics for the Energy Transition