'Collaboration between manufacturing and custom work companies for a circular future': results of the survey part 1

Research conducted by Sirris shows that ReX activities usually take place in-house, but the demand for collaboration is increasing. The recovery of used products and ROI are often stumbling blocks.

The pace of transition from a linear to a circular economy is increasing all the time, with the focus shifting to extended product lives in both the B2B and B2C markets. Equipment, machinery and other products are being reused if they are suitable for this purpose. This can be done through a process described as Reuse, Repair, Refurbish, Recondition, Remanufacture and Repurpose.

Together, these strategies are also referred to as ‘ReX’, and their goal is to prepare products that are used but not yet worn out for a new life. Although this approach presents opportunities in terms of sustainability, cost savings, innovation and collaboration, businesses are still hesitant about committing fully to it.

In order to gain a clear picture of the ReX landscape in Flanders, Sirris has surveyed 46 Flemish businesses in recent months. Our aim in doing so is to identify the specific challenges, opportunities and needs in more detail.

The participating businesses have a variety of backgrounds and areas of expertise. 94% already apply some form of ReX – a much higher percentage than the average across the Flemish manufacturing industry as a whole.

This first blog in a series of three provides an insight into the current status of lifespan extension at the businesses surveyed. Why do businesses use – or not use – ReX strategies? And what are the biggest challenges they face in going even further in this direction?

Insight 1: In-house repair the most commonly used approach at present

The three most common activities are repair, reuse of parts and refurbishing. 45% of these businesses do these things entirely on their own rather than in collaboration with others; only repurposing often involves external partners.

Insight 2: Businesses want to focus more on ReX collaboration

The survey of future ReX activities shows that businesses don’t have a clear preference for any particular ReX strategy. The only exception to this is repurposing, where products or components are given a new use:

This is seen as an important focus for future initiatives. Strikingly, the intention to collaborate in connection with future ReX activities is increasing. This makes sense. A high proportion of businesses currently organise their ReX processes internally, but with businesses looking to expand their ReX activities, they see the benefits of working with external partners such as custom work organisations to increase their impact and efficiency.

Insight 3: Financial and strategic benefits as drivers for ReX

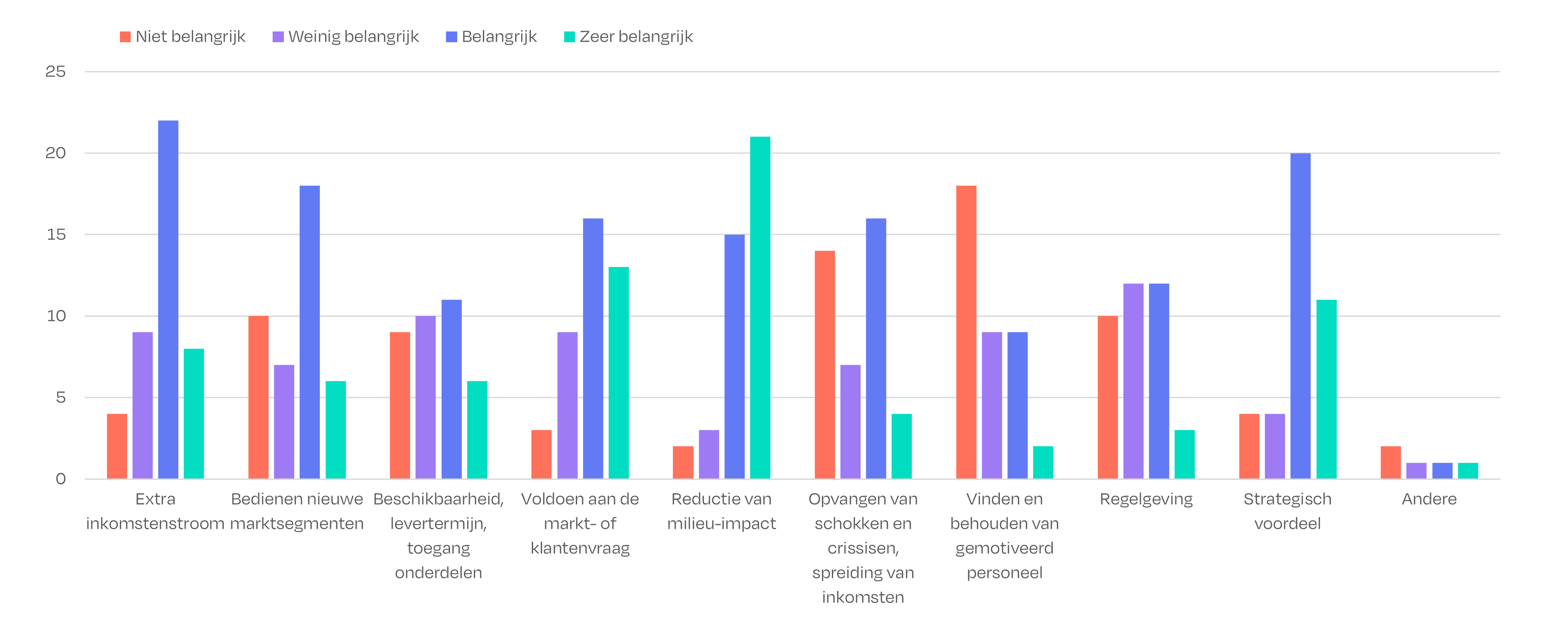

The graph below shows the drivers for implementing or initiating ReX activities.

For many businesses, the value of ReX strategies lies in the sustainable, financial and strategic benefits they offer. It is noticeable, though, that attracting and retaining motivated personnel is not so high on the agenda for most businesses: it is clear from the literature that this can in fact be an important driver.

Circular business models are increasingly seen as more attractive to employees who value sustainability, ethical entrepreneurship and social responsibility. This is a factor that businesses could make more use of – to reduce their environmental impact, but also to be an attractive employer in an increasingly competitive labour market.

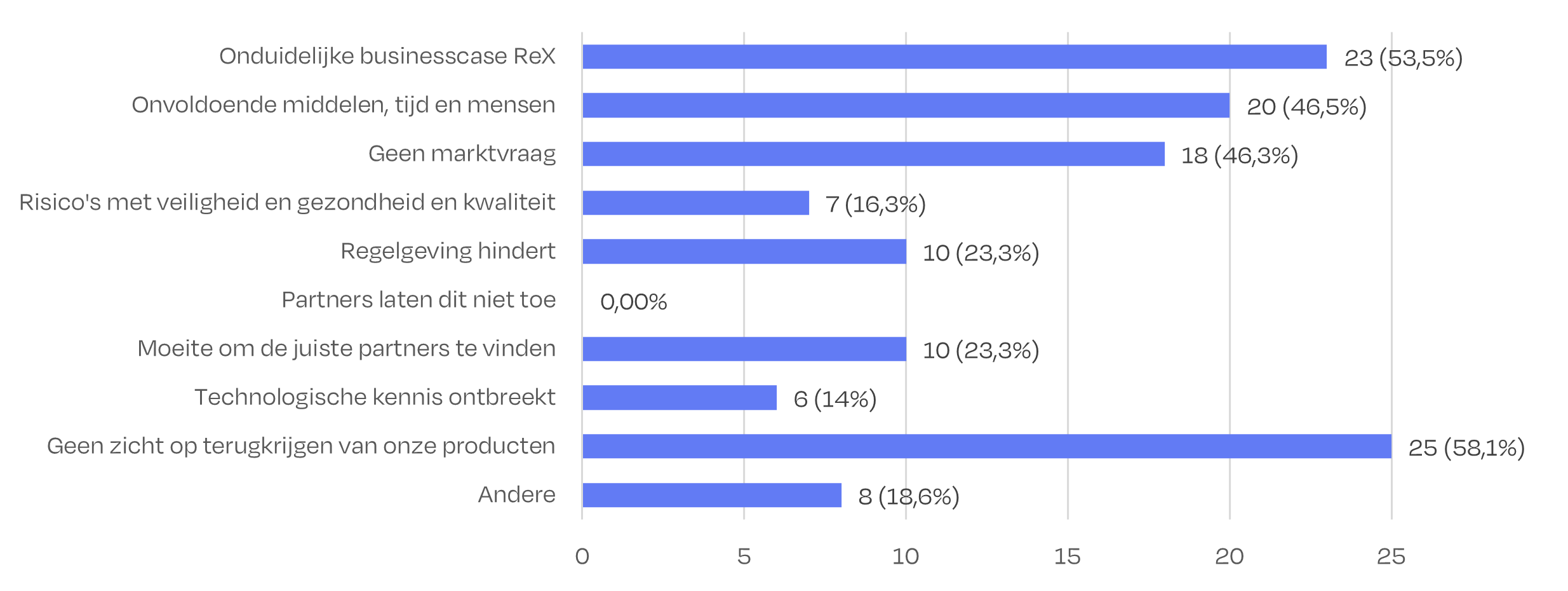

Insight 4: Recovering used products is the biggest challenge today

Often, businesses don’t know where their products are in the global chain for reuse, repair or recycling. There is also a lot of uncertainty about how, when or in what condition they will recover those products. This lack of insight hampers the effectiveness of ReX strategies, as businesses depend on products returning to keep their processes working properly.

More than half of the businesses also stated that it is difficult to justify ReX strategies. The initial investments for ReX are high and the financial benefits are not immediately apparent; in addition, many businesses report that demand for repaired or reused products is insufficient, meaning that there is little incentive to invest in ReX.

In our next blog in this series, we will share insights into working with customer work organisations and other businesses.

Would you like to receive the full survey report now?